If you’re a home carer, you may qualify for the Home Carer Tax Credit. This article explains exactly what the home carer’s tax credit is. You’ll also find out about the key rules that stipulate your eligibility and the current rates for the Home Carer’s tax credit.

CONTENTS

What is Home Carer’s Tax Credit

Qualifying for Home Carer’s Tax Credit

Rates

Claiming Home Carers Tax Credit?

What is Home Carer’s Tax Credit?

Home Carers Tax Credit is tax relief for married couples or civil partners (where they are assessed jointly for tax purposes), where one person stays at home caring for a dependent person. If one spouse or civil partner takes care of a dependent person at home, that person may qualify for a home carer’s tax credit that reduces the amount of tax they as a couple need to pay to the Revenue Commissioners.

Many people miss out either because they are unaware, or are unsure if they qualify. For example, a wife or husband taking care of the kids at home full-time is likely to qualify for the tax credit.

Who Can Claim Home Carer Tax Credit

There are a few conditions you need to meet to become eligible for a home carer’s tax credit. The conditions mainly relate to the definition of a dependent person. To determine eligibility to receive a home carer’s tax credit, one spouse or civil partner must be taking care of a dependent person.

A dependent person is defined as:

- A child who is eligible for Child Benefit payments.

- Anyone aged 65 years or older.

- Anyone with a physical or mental disability that requires care due to permanent incapacitation.

The dependent person cannot be your spouse or civil partner. However, a dependent person can be someone you are a legal guardian to or related to by marriage.

Do you need to be living with the dependent person?

The dependent person normally must live in the same household as you.

The exception means you can care for a dependent relative of either you or your spouse or civil partner outside the home if that person lives next door in a neighbouring residence, on the same property as you, or within 2 km of your home.

You must also have a direct communication link with your relative, such as a telephone line or alarm system.

If the person you care for is not a relative of either you or your spouse or civil partner, they must live in the same house as you for you to qualify for a home carer’s tax credit.

The other main condition for receiving the home carer’s tax credit is that the carer’s income is less than €10,400.

Home Carer Tax Credit Rates

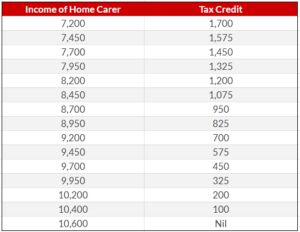

The full Home Carer Tax Credit rate for 2023 is €1,700. Regardless of how many dependents you are caring for, you can only claim this once a year.

Home carers who earn less than €7,200 annually can claim 100% of this tax credit. For income between €7,201 and €10,399, there is a reduced tax credit. If the home carer’s income exceeds €10,400, the household does not qualify for this tax credit.

Claiming Home Carers Tax Credit?

Irish Tax Rebates provides a simple service that can get you the highest rebate for the lowest fee. Irish Tax Rebates provide their services for a fraction of the cost of a tax accountant.

Best of all, if you are not entitled to a rebate, you don’t pay any fee to Irish Tax Rebates.

Apply online to check if you could be due tax back in the past four years in the form of a home carer’s tax credit or other tax relief:

New Customers: Apply here.

Existing Customers: Apply For Additional Rebate